The Psychology of the Stock Market

|

| The Psychology of the Stock Market |

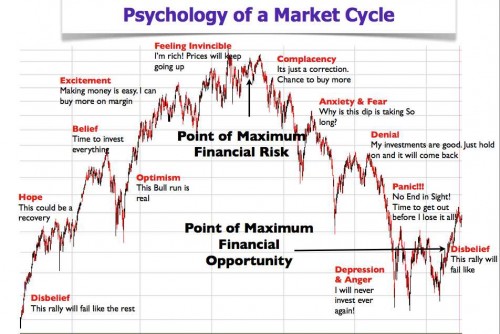

As we know that the stock market goes through cycles just like the weather goes through Summer and rainy season here in the Philippines. When the market goes up during a rally, it will always go down during a correction. Similarly, after every correction, it will go back up again. Although stock markets go up and down, it goes higher over time. Over time, it makes higher highs and higher lows, leading to a long term uptrend.

As the stock market goes through its cycle, investors ride a roller-coaster of emotions; from Excitement to depression. By feeling the emotional pulse of the market, you can roughly guess where you are in the market cycle. The point of maximum investment opportunity is when the market is feeling ‘Panic’ and ‘Disbelief’.

This is when stock prices are near the bottom or at early recovery. The worst time to invest (maximum risk) is when the market is feeling ‘optimism’ and ‘Excitement’. This is when stock prices are high and ready for the big fall. So, where do you think we are right now in the cycle?

This is when stock prices are near the bottom or at early recovery. The worst time to invest (maximum risk) is when the market is feeling ‘optimism’ and ‘Excitement’. This is when stock prices are high and ready for the big fall. So, where do you think we are right now in the cycle?

Tidak ada komentar:

Posting Komentar