Good day,

Attached, ---8< Cut and Paste >8---- , is the last portion of an article by a public fund manager in China confessing why he can never beat he "super wealth transfer machine"(stock market system) and decided to quit his job. And, after all, in his 10 years of career as fund manager, he already made more than 10million RMB as a salary despite losing money for his clients...

The full article, in Chinese, can be read from the link attached:

---------------------------------------Cut and Paste---------------------------------------------

一个公募基金经理的忏悔书

我无法对抗这个制度、我彻底投降、我准备辞职,我对我管理的基金的投资者表示深深的忏悔!我真的无能为力在这个市场中帮助你们赚钱!

中国XX基金管理公司 XXX基金经理

(恕我在此不公布老东家的名字,毕竟服务多年,领取了千万元的薪水!)

--------------------------------End of Cut and Pate ---------------------------------------------

http://bbs.hexun.com/stock/post_5_5961685_1_d.html

Anyway, this is the rules and regultion for fund managers world-wide. Imagine IF there is no such rule, what would happen, if most fund managers try to find exits for cash?

* OPPORTUNITY

Now, what would you do IF you are a fund manager under such rule?

The manager would at least want to beat the overall market index by selling the worse sectors/stocks and get a ride on the better sectors/stocks.

So, in order to sell 10% worth of weak stocks in his portfolio, the fund manager MUST FIRST purchase at least 10% of the equal value of stronger stocks before the software system allow him to sell the weak one.

This would result in lot of money rushing into relatively handful of sectors/stocks and result in sharp rally!

For Example: Some Internet/Games companies are the current percieved "safe harbour" and the money is rushing in at this point of time:(QIHU,DATE,GAME,YY)

..the above are just a few, can include the famous BIDU (but the up side is may not be that great as high price stock generally move slower... but safer).

*CONCLUSION:

It is better off spend your resources (time and money) to learn and DIY. The chances is very much higher.

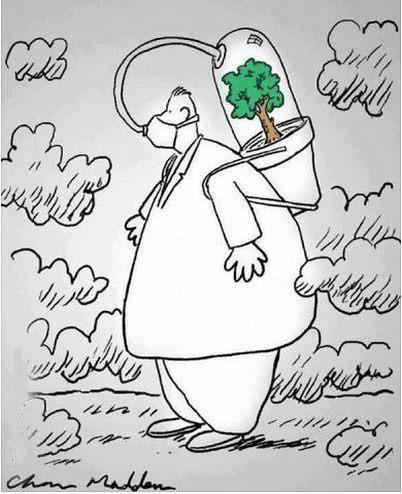

AND, off course... don't do this: Dash into the market without going throuh a proper stock market training, withot going through adequate paper practice, and without a reliable trading system. It is like the message from the following cartoon I found in facebook. :-)

Thank you for your time, and

Bless You

KH Tang

NOTE: THIS ARTICLE IS MERELY FOR AWARENESS ONLY!

Attached, ---8< Cut and Paste >8---- , is the last portion of an article by a public fund manager in China confessing why he can never beat he "super wealth transfer machine"(stock market system) and decided to quit his job. And, after all, in his 10 years of career as fund manager, he already made more than 10million RMB as a salary despite losing money for his clients...

The full article, in Chinese, can be read from the link attached:

---------------------------------------Cut and Paste---------------------------------------------

一个公募基金经理的忏悔书

我无法对抗这个制度、我彻底投降、我准备辞职,我对我管理的基金的投资者表示深深的忏悔!我真的无能为力在这个市场中帮助你们赚钱!

中国XX基金管理公司 XXX基金经理

(恕我在此不公布老东家的名字,毕竟服务多年,领取了千万元的薪水!)

--------------------------------End of Cut and Pate ---------------------------------------------

http://bbs.hexun.com/stock/post_5_5961685_1_d.html

Any way, here is a very very brief summary with the KEY FACTOR of why he can't win:

"The author, 10 years fund manager in China, described that the stock market is a wealth transfer machine.... Due to the fact that the fund managers, by Law and software system, must keep at least 60% of the money in the market. Even if the fund manager want to get out of the stock and keep cash when the market is clearly in down trend or even crashing, the software would not allow them to sell...."Here are some points of ponder:

* FACT

Now, the above chart showng the China Shanghai and ShenZhen 300 index (SSE300). There is clearly more down trend than up trend for the past 5 over years. And, if one were not only can't short the market, but also must spend at least 60% of the fund to purchase stocks at any point of the time. As a Public Fund Manager, how can they make money as the calculated probability seriously against them?

Now, the above chart showng the China Shanghai and ShenZhen 300 index (SSE300). There is clearly more down trend than up trend for the past 5 over years. And, if one were not only can't short the market, but also must spend at least 60% of the fund to purchase stocks at any point of the time. As a Public Fund Manager, how can they make money as the calculated probability seriously against them?

Anyway, this is the rules and regultion for fund managers world-wide. Imagine IF there is no such rule, what would happen, if most fund managers try to find exits for cash?

* OPPORTUNITY

Now, what would you do IF you are a fund manager under such rule?

The manager would at least want to beat the overall market index by selling the worse sectors/stocks and get a ride on the better sectors/stocks.

So, in order to sell 10% worth of weak stocks in his portfolio, the fund manager MUST FIRST purchase at least 10% of the equal value of stronger stocks before the software system allow him to sell the weak one.

This would result in lot of money rushing into relatively handful of sectors/stocks and result in sharp rally!

For Example: Some Internet/Games companies are the current percieved "safe harbour" and the money is rushing in at this point of time:(QIHU,DATE,GAME,YY)

..the above are just a few, can include the famous BIDU (but the up side is may not be that great as high price stock generally move slower... but safer).

*CONCLUSION:

It is better off spend your resources (time and money) to learn and DIY. The chances is very much higher.

AND, off course... don't do this: Dash into the market without going throuh a proper stock market training, withot going through adequate paper practice, and without a reliable trading system. It is like the message from the following cartoon I found in facebook. :-)

Thank you for your time, and

Bless You

KH Tang

NOTE: THIS ARTICLE IS MERELY FOR AWARENESS ONLY!

.jpg)

.jpg)

.jpg)