Selasa, 31 Juli 2012

Senin, 30 Juli 2012

Banco De Oro: What will you do if you forgot BDO ATM Debit Card pin code?

Banco De Oro: What will you do if you forgot BDO ATM Debit Card pin code?

I've been working outside the country for almost 4 years now and everytime i'm going back home for vacation I often forgot ATM pin code of my ATM Debit Card account in Banco de Oro (BDO). Luckily the receipt where my pin code is place has been keep my mother in her files folder.

I wonder what if ever it will happen again to me and no chance to retrieve my ATM pin code. What should I do? So I decided to contact and asked Banco de Oro (BDO) regarding forgotten ATM Debit Card pin code. I was told that the only solution is to “purchase” a new BDO ATM Debit Card from the branch of your BDO account for Php. 120.00.

Here’s BDO’s email response to my inquiry about forgotten ATM Debit Card pin number:

We regret to inform you that we have no facility to reset ATM PIN. In case of forgotten ATM PIN, card replacement is necessary since no one in the bank, not even the ATM network system, has knowledge of your nominated 6-digit PIN.

ATM card replacement can only be requested and claimed from your Branch of Account (BOA). Please be informed as well that your BOA will collect a Card Replacement Fee of Php 120.00 upon requesting for a replacement.

You may claim your personalized/named ATM card from your BOA after 3-5 banking days or if you opted to get a generic (no name) ATM card, you may get it right away provided that your BOA has a generic card on hand.

In relation to this, you are given three (3) invalid PIN attempts daily. Once you have entered an invalid ATM PIN thrice, your ATM access will be suspended for the day and you may try again the next day.

Thank you for banking with BDO.

I've been working outside the country for almost 4 years now and everytime i'm going back home for vacation I often forgot ATM pin code of my ATM Debit Card account in Banco de Oro (BDO). Luckily the receipt where my pin code is place has been keep my mother in her files folder.

|

| BDO ATM Debit Card |

Here’s BDO’s email response to my inquiry about forgotten ATM Debit Card pin number:

We regret to inform you that we have no facility to reset ATM PIN. In case of forgotten ATM PIN, card replacement is necessary since no one in the bank, not even the ATM network system, has knowledge of your nominated 6-digit PIN.

ATM card replacement can only be requested and claimed from your Branch of Account (BOA). Please be informed as well that your BOA will collect a Card Replacement Fee of Php 120.00 upon requesting for a replacement.

You may claim your personalized/named ATM card from your BOA after 3-5 banking days or if you opted to get a generic (no name) ATM card, you may get it right away provided that your BOA has a generic card on hand.

In relation to this, you are given three (3) invalid PIN attempts daily. Once you have entered an invalid ATM PIN thrice, your ATM access will be suspended for the day and you may try again the next day.

Thank you for banking with BDO.

Minggu, 29 Juli 2012

Next step: Sell commodities, Buy Biosensors

The first investment decision I made in my life was to invest $15,000 in a commodities fund back in 2007. It was a bad decision as I lacked investment knowledge and was unaware of the charges involved. My next step is to cut loss and sell the fund once its value reaches $13,000.

Also, Biosensors meets all the requirements stated in my previous post - Stockpiling Strategy by Phil Town. It is also about 40% below its sticker price, offering a substantial margin of safety. Biosensors seems undervalued with strong earnings growth and a healthy balance sheet. Current price is near its 52 week low and PE is much lower than industry and sector average. The company has low debt and flushed with cash. The recent price correction is due to pricing pressures in China and Japan and ASP drop in stent. One drawback of this stock is that it does not pay dividends. In my opinion, the potential capital gain outweighs the dividends and it might pay dividends in future as Biosensors is still in the expansion phase. I will monitor the next few days and probably buy 3 lots of Biosensors at a target price of $1.18.

Kamis, 26 Juli 2012

Are Mentors Important in Setting Up a Business?

Are Mentors Important in Setting Up a Business?

By Dean Pax Lapid

|

| Mentoring |

Are Mentors Important in Setting Up a Business?

By Dean Pax Lapid We recently concluded an ENTREP M.B.A. at the Asian Institute of Management for two days. Yes, actually two half days (midweek of Wednesday 6pm-10pm and the following Saturday 1pm-5pm) only. Our workshop was attended by 42 serious participants coming from the professional world (some retiring, others wanting and others hoping to become instant entrepreneurs). But our M.B.A. is not the AIM masters degree program but rather what I coined “Magandang Business Advice”- in business parlance MENTORING.

Roughly half of these professionals want “instant businesses” just like instant 3-in-1 coffee. To make it happen, you need some catalyst. If you read my GoNegosyo book, 21 Steps on How to Start Your Own Business, I had a chapter about three elements of what people always want in a deal – CHEAP, QUICK & GOOD.

Especially in business set-up, CHEAP/QUICK is not necessarily GOOD. (That’s why I always caution people to study the deals with franchisors offering promotions such as buy-one take-one in a cart business). If the business is really good from the franchisor’s perspective, why then is he offering it at a hefty discount? QUICK/GOOD is not necessarily CHEAP. That’s why they went for the hardcore mentoring at AIM.

Especially in business set-up, CHEAP/QUICK is not necessarily GOOD. (That’s why I always caution people to study the deals with franchisors offering promotions such as buy-one take-one in a cart business). If the business is really good from the franchisor’s perspective, why then is he offering it at a hefty discount? QUICK/GOOD is not necessarily CHEAP. That’s why they went for the hardcore mentoring at AIM.

(By the way you do not need to pay AIM rates. Bro Bo is organizing the 5th ENTREP WORSHOP under the TRULYRICHCLUB this July 14th/28th, two full days of entrepreneurship workshop to crack your business passion, evolve your creative idea into a profitable business, and work out your high level business plan mentored by three AIM professors). I’ll be your tor-mentor and mentor at the same time! LOL.

Seriously, I hope there’s still some slots open as I only accept 50 committed students. YES, MENTORING IS VERY IMPORTANT TO DIRECT YOU TO THE PATHWAY OF BUSINESS SUCCESS!

Let me give you an actual mentoring situation for one of our participants of the Entrep MBA. They were mentored by Sir Ardy Roberto (my co-angelpreneur).

Hi Sir,

Thank you so much for mentoring us (me and my husband) last MBA session. I really noted your suggestions on how I can start up again with my ‘events’ business. I finally thought of a possible name: “Glitz and Glamour Event Management” (no matching record yet in DTI), and somehow I believe it’s relevant to the business (hehehe). Also, I was able to read your two books already (Buhay na Hindi Bitin and Pera na Hindi Bitin)...and I really learned a lot...and gave me inspiration.

Just want to share my thought. Thank you once again. More power!

Cheers,

Jac

Hi, Jac

Thanks for the feedback. I am happy that you got value from the seminar and the mentoring session. About your proposed name, you might want to test it first to your prospective customers. I personally think that the name is too long. Perhaps you might want to shorten it to Glamour Events Management (GEM) -- the abbreviation is memorable also.

You can also add your name to the name in your branding so that it looks very personal, e.g. GLAMOUR EVENTS MANAGEMENT by Jac Oebanda Weddings, VIP Functions, Product Launches, ______ (list here the kind of events you do) Hope all will go well with you.

Hi Sir Ardy,

Thank you once again for the suggestion on the name- GEM. With that I was inspired to create my own logo over the weekend (kindly see attachment).

I am now composing my letter to my friends and families to inform them that I’m back to do business again...as you suggested as well...

Hoping for your continuing support. More power to all ANGELpreneurs!!!

Cheers,

Jac

Just to highlight the impact of mentoring – here are some short comments amongst the participants gathered by the Entrep MBA organizers:

Thank you Sir Pax,

I’ve learned from the two half-day sessions of MBA. I consider you as one of my mentors. Your book will also be a guide for me in building my business. I hope that the two-day MBA seminar will not be the last we can contact you to ask some help and guidance in developing our business.

Thank you, thank you so much,

Ed Tengco (Photo Booth Business) More time given each topic and mentoring. Most sulit seminar ever! Thank you. Keep up the good work on inspiring current and future entrepreneurs! (Hanna Buena-Pet Grooming business)

Good job!!! Sobrang sulit ng seminar na ito. I’ve learned a lot. Thank you and God bless... I’ve learned a lot! Looking forward to seeing you guys again. Good job Dean Pax!

Though we were not given enough time to answer the assignment, it made us realize the businesses that we really want to do. We had a wonderful time. I’m not the business type but this was really insightful.

I hope there will be a sort of ‘call an angelpreneur’ or ‘business help online’ It was a great experience. Hope to attend more soon. You have a great vision for the future of the country.

Thank you for holding this kind of hopeful seminars. I love everything in it! Thank you for the lessons imparted to us. This would be a great help in our journey..

Now to our MENTORING topic (I’m back in the Dean mode)One of the success factors to developing a new business is getting one or more mentors. The level of mentoring can go from adhoc advice (just like what we did at MBA recently) to close-mentoring on a weekly basis (what I did for my Entrep students at ESA when I was dean of the program).

Here are my four reasons why mentors are important:

|

| Mentor wealthstrategy |

2. Another important element of mentoring for early stage business is the ability of the mentor to open doors for the new company. As a mentor, you must open your network of contacts to your mentee. I remember the difficulty of my young ESA students to penetrate the building administrator of a big mall. I had to negotiate with the mall’s leasing group for my five students to be located at the basement of the mall. A good mentor should be able to help young entrepreneurs get past the entry barriers.

3. Within our GoNegosyo circles, we each have our core competences. I use other angelpreneurs other than myself when it comes to particular areas of competence. There are areas where I have the business information but am not the expert- such as accounting (Tess Dimaculangan), marketing (Sir Ardy Roberto), product development (Prof. Reuel Virtucio). These mentors with their particular expertise can be very helpful in guiding young entrepreneurs from making mistakes that may take months to uncover.

4. Finally,a mentor must have the helicopter view of the business. Imagine a helicopter that is able to hover on top of the trees (forest) and yet able to lower (focus) within a specific area. Having a helicopter ‘view’ enables a good mentor to ask difficult questions about the high level business plan at the same time deal in particular elements of the business such as mission, objectives and ideas that could be overlooked by the entrepreneur.

Some of the difficult questions I have posted regularly were:

* Why are you doing this business other than money?

* Why are you not looking at a particular segment or solution?

* Why are you proposing to do this (strategy) in the first place?

In summary, passion/enthusiasm alone will blind the wanna-be entrepreneurs to obvious mistakes in his business plan. Mentors are critical to the sustainable development of a new venture.

Let me share with you a caption that I have encountered while doing my PhD research work (Finishing Well by Bob Buford p.73) which blends well into our mentoring topic. This is inspired from distinguished characters in the New Testament.

“Every man needs a Paul, a Barnabas and Timothy in his life. They need an older, wiser man like Paul who doesn’t have all the answers but who has been on the planet longer and can help find the answers.

Everybody needs a peer like Barnabas who can look them in the eye and say –you’re screwing up, so get your act together. Finally, everybody needs Timothy, a younger man they can bring along and help grow.”As an Entrep mentor, my heart is pumping, my mind is thinking! I love what I’m doing and my family is enjoying it. I’ll continue living for as long as some young (mentee) keeps on growing.

May you all be blessed to find your mentors that will encourage, push and guide you in your quest for business (and most especially your spiritual life)!

About Dean Pax Lapid

Selasa, 24 Juli 2012

Philippines Mutual Funds Performance – 2nd Quarter 2012

Philippines Mutual Funds Performance – 2nd Quarter 2012

YEAR-TO-DATE PERFORMANCE OF MUTUAL FUNDS IN THE PHILIPPINES

As of the 2nd Quarter of 2012 (January to June 2012)

EQUITY FUNDS (primarily invested in Peso equity securities)

1. Philam Strategic Growth Fund – 22.51%

2. Philippine Stock Index Fund – 21.39%

3. Philequity Fund – 21.20%

4. Sun Life Prosperity Phil. Equity Fund – 19.19%

5. Philequity PSE Index Fund – 18.49%

6. ATRKE Equity Opportunity Fund – 17.63%

7. First Metro Save and Learn Equity Fund – 17.58%

8. United Fund – 8.64%

FOREIGN CURRENCY-DENOMINATED EQUITY FUND

* ATR KimEng AsiaPlus Recovery Fund – (-2.95%)

BALANCED FUNDS (primarily invested in Peso debt and equity securities)

1. GSIS Mutual Fund – 21.48%

2. Philam Fund – 20.57%

3. Bahay Pari Solidaritas Fund – 19.22%

4. NCM Mutual Fund of the Phils. – 17.76%

5. ALFM Growth Fund – 16.89%

6. First Metro Save and Learn Balanced Fund – 16.32%

7. Sun Life Prosperity Balanced Fund – 14.14%

8. Optima Balanced Fund – 13.87%

9. ATRKE Philippine Balanced Fund – 13.80%

FOREIGN CURRENCY-DENOMINATED BALANCED FUNDS

1. Cocolife Dollar Fund Builder – 4.44%

2. Paradigm Global Growth Fund – 4.15%

3. Sun Life Prosperity Dollar Advantage Fund – 2.32%

4. PAMI Asia Balanced Fund – 0.15%

BOND FUNDS (primarily invested in Peso debt securities)

1. Cocolife Fixed Income Fund – 4.68%

2. First Metro Save and Learn Fixed Income Fund – 2.77%

3. Philequity Peso Bond Fund – 2.08%

4. Ekklesia Mutual Fund – 1.97%

5. ALFM Peso Bond Fund – 1.66%

6. Prudentialife Fixed Income Fund – 1.38%

7. Sun Life Prosperity GS Fund – 1.36%

8. Sun Life Prosperity Bond Fund – 1.20%

9. Grepalife Fixed Income Fund – 0.87%

10. Philam Bond Fund – 0.50%

11. Grepalife Bond Fund - (-0.08%)

FOREIGN CURRENCY-DENOMINATED BOND FUNDS

1. Philequity Dollar Income Fund – 5.58%

2. Sun Life Prosperity Dollar Abundance Fund – 4.76%

3. Philam Dollar Bond Fund – 4.64%

4. ALFM Dollar Bond Fund – 4.19%

5. ALFM Euro Bond Fund – 4.06%

6. Grepalife Dollar Bond Fund – 2.40%

7. ATR KimEng Total Return Bond Fund – 1.08%

8. PAMI Global Bond Fund – (-0.41%)

9. MAA Privilege Dollar Fixed Income Fund - No data

10. MAA Privilege Euro Fixed Income Fund – No data

MONEY MARKET FUNDS (primarily invested in short-term Peso securities)

1. Philam Managed Income Fund – 1.45%

2. ALFM Money Market Fund – 1.29%

3. First Metro Save and Learn Money Market Fund – 1.15%

4. Sun Life Prosperity Money Market Fund – 0.26%

5. ATRKE Alpha Opportunity Fund – 0.08%

All data are from the Philippine Investment Fund Association (PIFA).

Disclaimer: Although the rate of return is a good measure of performance, other things such as the fund’s consistency of return and exposure to risks must also be considered. Note that the fund’s past performance is not and cannot be a guarantee of future returns.

Source:

http://www.pinoymoneytalk.com

Updated Stock Watchlist

Common Stocks

Vicom Limited

Boustead Sp

ST Engineering

Biosensors

OCBC

Singtel

Reits

Ascendasreit

Capitamall Trust

SuntecReit

Vicom Limited

Boustead Sp

ST Engineering

Biosensors

OCBC

Singtel

Reits

Ascendasreit

Capitamall Trust

SuntecReit

Double Your Earnings By Doubling Your Learning

Double Your Earnings By Doubling Your Learning

|

| Double earning, Double your learning |

If you become a TrulyRichClub member like me, you will receive many inspiring thought, views and advice about investing in stock market, wealth strategy etc.. Below just want to share an article i received from the club of Bro. Bo Sanchez on how he double his earning over time. ---

Last week, I flew to Sydney, Australia for six days. (The world is small. I didn’t want to absent myself from our Sunday PICC Feast where I preach every week, so I left Sunday night and arrived Saturday afternoon. That was cool.)

It was sweet meeting our wonderful friends in the small Light of Jesus branch in Sydney. Yes, as usual, I preached in a special Feast we organized there. But that was only one night of my six days there. Because I went to Sydney as a STUDENT...

Fantastic Hillsong Worship

I went to Sydney primarily to attend the 5-day Hillsong Conference. It’s a Christian conference attended by 20,000- plus people from all over the world. They’ve been holding the Conference for 25 years now. Each year, preachers from around the world are invited to speak. This year, it was Joyce Meyer, Louie Giglio, Steven Furtick, Joseph Prince, etc.

As you know, we also hold a gigantic conference each year called Kerygma Conference every November. Last year, we had 10,000 people. So we wanted to improve what we do and the best way of doing that was learning from others who’ve been doing it longer and better than we do.

Hillsong is known for their fantastic worship. So aside from worship leaders in Hillsong such as Darlene Zschech and Reuben Morgan, they invited the biggest worship leaders in the world, like Chris Tomlin, Matt Redman, and Israel Houghton. I loved it.

For five days, I was a student. I didn’t preach. I listened. I sat amongst the crowd, sometimes way up in the bleachers, drinking it all in—the atmosphere, the wisdom, the blessings.

Very few people knew me, which was absolutely heavenly. For five days, I could freely walk around the corridors as one of the attendees, not being stopped for photographs and autographs.

I also brought with me 29 preachers and leaders from Light of Jesus—and all of them were spiritually recharged like myself. They too experienced what I experienced. We all became students. Because here’s what I found out: The best leaders in the world are eternal students.

The Power of Humility

Why is Light of Jesus Family (that’s the name of our 32-year-old spiritual community) experiencing such explosive growth the past few years? There’s no other answer: God’s mercy. It’s pure grace, I tell you. But I feel that God had to look for people who were OPEN to receive His mercy and grace. And that opening is humility. And humility is the foundation of being an eternal student.

In the same way that I have financial mentors surrounding me so that my businesses flourish, I surround myself with spiritual mentors. These are spiritual giants who lead bigger communities and churches than those that I lead. They consist of bishops, priests, pastors, preachers, authors, missionaries…

I seek them out. I read their books. I listen to their audio talks. I watch their preaching. I have long chats with them over coffee. I pepper them with questions. I attend their seminars, conferences, workshops. And I ask for their prayer.

The Problem with Natural Abilities

The Bible says, “Wise men and women are always learning, always listening for fresh insights” (Proverbs 18:15). It’s the wise who keep learning.

It’s the foolish who say “I know what I’m doing. I’ve been doing it for years. I don’t need to attend talks, go to seminars, or seek a mentor.”

And that’s the problem with some people with natural abilities and talents. Because of the natural talent that God has given to them, they’ll experience moderate success at the beginning. Which then fills them with pride. Many times, a very talented person isn’t very teachable. Which is sad.

But if a naturally talented person makes a choice to be an eternal student, his success grows exponentially year after year.

What Will Bring Abundance into Your Life

Have you met a “Know-It-All”? I met one the other day. He said he was a businessman for 14 years. But through our 15-minute conversation, I learned that his business was going through hard times.

I asked him, “Do you have a business mentor?” He didn’t even know what the word meant. So I explained to him, “You need to look for a businessman who is 20 times more successful than you are in your particular business.”

His next statement floored me. He said, “There’s really nothing else I need to know. I’ve been doing this business for 14 years now. It’s just a bad economy, that’s all. That’s why we’re going through a rough time.”

I didn’t tell him what I learned from MY mentors: That great businesses are like surfers who ride whatever economic wave comes to them. The bigger the wave, the higher the surfer goes! Great businesses can become more profitable during recessions.

I didn’t tell him that he needed to improve his relationship marketing—because he wasn’t listening. I didn’t tell him that he needed to build his relationships with the key people in his business—because he wasn’t listening.

I didn’t tell him that his main product has become outmoded and he needed to cannibalize his product with an upgraded one—because he wasn’t listening.

He wasn’t a student. He was clearly a man with great abilities. But abilities aren’t enough. Read carefully: It’s not your abilities but your attitude that will bring financial abundance. Specifically, your attitude of being an eternal student.

Ten Questions to Know If You’re a Student

Chisel this truth on stone: If you stop learning, you stop leading. Because a leader is a learner. If you want to double your earnings, double your learning. Futurist John Naisbitt said, “The most important skill to acquire is learning how to learn.”

Here are 10 questions that Leadership Expert John Maxwell suggests that we ask ourselves, to measure how teachable we are:

* Am I open to other people’s ideas?

* Do I listen more than I talk?

* Am I open to changing my opinion based on new information?

* Do I readily admit when I am wrong?

* Do I observe before acting on a situation?

* Do I ask questions?

* Am I willing to ask a question that will expose my ignorance?

* Am I open to doing things in a way I haven’t done before?

* Am I willing to ask for directions?

* Do I act defensive when criticized, or do I listen openly for truth?

Did you answer “No” to any of these questions? If so, be humble. Be teachable. Be a student and work on your humility.

The Best Investment in the World

|

| Truly Rich Club |

You’ve heard me say that the stock market—as long as you use our very own SAM—is the best, easiest, most PROFITABLE investment you can ever make. But there’s one investment that beats the stock market, hands down. Shocked? It’s true.

The best investment is investing in YOURSELF. At the beginning, when I started buying books or attending seminars, it hurt. Because they were expensive. At least, in my “poverty-conscious” mind, it was expensive.

But as the years went by, I no longer saw buying a book or attending a seminar as expensive. It was cheap—considering the PROFIT I will earn when I apply what I learned.

In my lifetime, I’ve bought almost a million pesos worth of books. (I’ve got two rooms filled with my books—and it’s crammed from floor to ceiling.) I’ve paid lots of money to attend seminars and workshops all over the world, paying for my plane fares and hotels, forking out millions over my lifetime. Not only that, I’ve paid for “online courses” that have doubled and tripled my income over time too.

Yes, I’ve gotten back all my investments to my learning multiplied many, many times! Are you ready to invest in yourself?

Hey, investing in yourself doesn’t even have to be that big. Sometimes, it could be very small—but the returns can be out of this world too. Classic example? The TrulyRichClub. For only Php. 497 or Php. 975 a month (depending if you’re a Gold or SuperGold member), you can already invest in the stock market with confidence and build a sizable retirement fund that will be in MILLIONS in the next 20 years or more. You can learn strategic insights that will save you from so many financial troubles and make you earn so much more.

For those who are SERIOUS in becoming successful entrepreneurs, you need to INVEST a bit more—but it’s an investment that will return many times over.

Example? I strongly recommend that you attend Dean Pax’ 2-Day TrulyRich Entrepreneur’s Workshop. (We’ll have another run soon.) Even better, join my WealthCircle, the highest level of the TrulyRichClub. You’ll be surrounded by mentors who will inspire you and guide you in building your business throughout the year.

Do you want to double your earning? Double your learning. No matter how successful you become, always be an eternal student.

May your dreams come true,

Bo Sanchez

Senin, 23 Juli 2012

Questions From The Future.

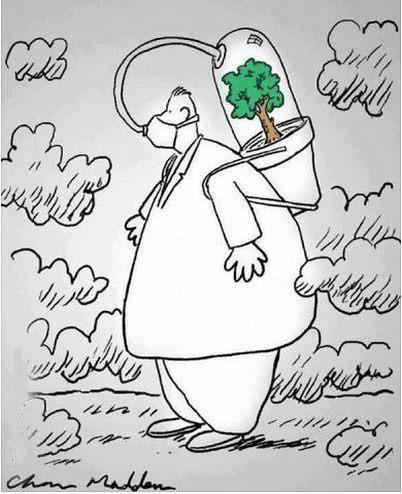

IMAGINE that if you were to invite by aliens to have a tour in to the galaxy and return to earth a 100 years later... Or, reincarnated onto earth plane few generations later....

What will the earth look like when you return?

Or If you have a choice,

What would you like to see?

The following diagram illustrates how material wealth is produced. We can either grow it on earth or mine it from earth and process it.

Gold Mining:

Satellite Photos on Amazon Deforestation:->

Photo on year 2000:

Photo on year 2009:

Dilemma for modern Economy:

Apparently, the modern society MAINLY measure wealth by counting how much toys can a person accumulate. The more and faster it progress, the harder the earth will be squeezed. And, Easter Island is just an example.

.

Here is a relevant video by Professor Albert Bartlett :

"The Greatest Challenge" humanity is facing

---------------------------------------------------8<---------------------------------------------------------

“To reverse the effects of civilization would destroy the dreams of a lot of people. There's no way around it. We can talk all we want about sustainability, but there's a sense in which it doesn't matter that these people's dreams are based on, embedded in, intertwined with, and formed by an inherently destructive economic and social system. Their dreams are still their dreams. What right do I -- or does anyone else -- have to destroy them.

At the same time, what right do they have to destroy the world?”

“We cannot hope to create a sustainable culture with any but sustainable souls.”

― Derrick Jensen, Endgame, Vol. 1: The Problem of Civilization

---------------------------------------------------8<---------------------------------------------------------

Relevant picture added on 7 Dec 2012 found in facebook -"Knowledge of Today"

“Only when the last tree has died and the last river been poisoned and the last fish been caught will we realize we cannot eat money.” ~Cree Indian Proverb

<HOME>

Minggu, 22 Juli 2012

SSS Contribution Table 2012, Monthly Payment deadlines

SSS Contribution Table 2012, Monthly Payment deadlines

Here is the latest SSS Contribution Table for 2012. I got a copy when I visited SSS branch in Sta. Cruz, Laguna to pay for my monthly SSS contribution and process my SSS ID. For sure I am not the only one who wants to know about it so I write about this. Or to find out more detail visit www.sss.gov.ph

Details for SSS Contribution Monthly deadlines of payment:

There are respective dates for you to pay your monthly contribution to avoid penalty. Let us say your SSS number ends in one or two (1 or 2) your payment deadline is on every 10th day of the month. If ending digit is zero (0) your payment deadline is on every last day of the month. If the payment deadline falls on weekends and holiday, payments can be done one the next working day. Otherwise, Respective penalties will be imposed.

Here is the latest SSS Contribution Table for 2012. I got a copy when I visited SSS branch in Sta. Cruz, Laguna to pay for my monthly SSS contribution and process my SSS ID. For sure I am not the only one who wants to know about it so I write about this. Or to find out more detail visit www.sss.gov.ph

|

| SSS Contributions Table |

Details for SSS Contribution Monthly deadlines of payment:

There are respective dates for you to pay your monthly contribution to avoid penalty. Let us say your SSS number ends in one or two (1 or 2) your payment deadline is on every 10th day of the month. If ending digit is zero (0) your payment deadline is on every last day of the month. If the payment deadline falls on weekends and holiday, payments can be done one the next working day. Otherwise, Respective penalties will be imposed.

Dividend Discount Model (DDM)

The Dividend Discount Model is suitable for:

- Companies that pay dividends consistently (Singpost?)

- Companies that have established a dividend policy (Starhub?)

- Seasoned companies that are profitable non-high growth companies (e.g Utilities)

Here's the formula for DDM:

P = Fair value of stock using DDM

- Companies that pay dividends consistently (Singpost?)

- Companies that have established a dividend policy (Starhub?)

- Seasoned companies that are profitable non-high growth companies (e.g Utilities)

Here's the formula for DDM:

P = Fair value of stock using DDM

D = Value of dividends

g = growth rate of dividends (can take growth of earnings as proxy)

r = investor's required return

Selasa, 17 Juli 2012

Stockpiling strategy by Phil Town

Requirements:

1) 5 or 10 year average return on Invested Capital (ROIC) > 10%2) 5 or 10 year average equity growth rate (Book value per share) > 10%

*Check current BV per share by dividing Total Equity by Total Shares Outstanding

3) 5 or 10 year average Sales growth rate > 10%

4) 5 or 10 year average earnings growth (EPS) > 10%

5) 5 or 10 year average growth rate of cash from operating activities > 10%

6) Total long term debt/Total income < 3

7) Payback time < 10 years

- Find market capitalization of company

- Find ttm earnings

- Grow it forward at 5/10 year average earnings growth rate until the cumulative earnings exceeds market capitalization.

7) Payback time < 10 years

- Find market capitalization of company

- Find ttm earnings

- Grow it forward at 5/10 year average earnings growth rate until the cumulative earnings exceeds market capitalization.

Find the sticker price:

Sticker price of a business is determined by the kind of surplus cash it can produce for its owners in the future.

1) Earnings per Share (EPS) for the last twelve months(ttm)

2) EPS growth rate for the next ten years

- Use the 5 or 10 year average earnings growth rate

- Retrieve from analyst reports

- Retrieve from analyst reports

3) Price to earnings (PE) ratio in ten years

- Find 10 year average PE ratio

- Find 10 year average PE ratio

- Double the estimated future earnings growth rate (Use analysts' average estimate of future growth of earnings or use 5 to 10 year average earnings growth rate)

- Use the lower figure of the two methods above

4) Minimum Acceptable Rate of Return (MARR) = 15%

5) Run the numbers through calculator on paybacktime.com

Find the Margin of Safety Price

5) Run the numbers through calculator on paybacktime.com

Find the Margin of Safety Price

50% of sticker price calculated above

Capital Allocation

Capital Allocation

| Capital | Number of businesses | % of capital allocated to each initial buy |

| $1,000 - $20,000 | 1 | 25% |

| $20,000 - $40,000 | 2 | 25% |

| $40,000 - $70,000 | 3 | 25% |

| $70,000 - $100,000 | 4 | 25% |

| $100,000 - $100,000,000 | 5 | 25% |

Note: Time purchases with the help of technical analysis using Floor and Ceilings.

*A price move of over 3 percent above the Ceiling or below the Floor, accompanied by 150% of the average volume, is a significant sign of a breakout that will last

Project Freedom (7): The Galaxy Chart

Good day,

This article is a continuation of the previous entry of the blog...

----------8< (Cut and paste from Wikipediaon Dow Theory >8------------

The Dow Theory on stock price movement is a form of technical analysis that includes some aspects of sector rotation.

------------------------------------------- 8<--------------------------------------------

As one can see from the above statement that the idea of Sector Rotation had been officially around for at least a century, but, if one were to flip through the whole library of Technical Analysis books in the library, he may not find more than 3% of the books mention about it(been there, done that). And, even if one can find such topic in the book, most of them merely touching the surface by introducing that there is such thing around.

Personally, I think that the traditional way of analyzing the price chart is hard to VISUALIZE how these rotation take place. Here is to introduce a tool that could facilitate the user to visualize and understand how the Rotational of the stocks/sectors are taking place in the market. Thanks for the exponential grow of personal computer's speed over the years and these CPU intensive tasks can be handled with ease nowadays. :-)

(1) Transformation of Traditional Chart into a X-Y Cartesian Plane.

Figure 1: Transformation of Traditional Chart into a X-Y Cartesian Plane.

Figure 1 shows how a normal chart can be transformed into The Galaxy Chart in showing the Relative Momentum and Trend of multiple stocks. Though the human eyes can ONLY see the 2-dimensional chart, it is up to the programmers' IMAGINATION to incorporate N-dimensional information into it. For instance, add a filter to get rid of those stocks that are moving side way.

(2) Understanding the meaning of The Galaxy Chart

Figure 2. The Galaxy Chart

Figure 2 shows a typical Galaxy Chart. Every stock is represented with a comet-like diagram with multiple dots in its tail. The POSITION of the biggest dot in the comet represent the last bar's RELATIVE STRENGTH of the momentum and trend with respect to others stock in a same watch list. The length of the comet tail can be set by the user, and each additional dot appears on the tail mean an additional look-back period. Therefore, the DIRECTION and LENGTH between the dots show the change of strength in Momentum and Trend dynamically over time. So, it provides more information than a normal static list of stock scan from explorer as it shows the dynamic trail.

Figure 3. Zooming-in to the Upper Right Corner where both Momentum and Trend are both Postive.

Figure 4. Statiscal and Probability wise...

.

Figure 4 is to illustrate how to focus on the fastest moving stocks visually. Note that there is a criss- cross with grid lines in the center of the chart, which represent the (0,0) origin position of the X-Y co-ordinate. The upper half of the chart represent the +ve momentum and lower half of the chart represent -ve momentum. While the right hand side of the chart represent the +ve trend, and the left hand side represent the -ve trend.

Therefore, the top right corner of the chart can only be populated with stocks that are both +ve in momentum and trend. The further away from the center are the faster the runner, and they are not range-bound. While the bottom left corner is just exactly opposite. (Note that the distribution chart in the figure is for illustration purpose ONLY, it does not mean that the stocks in the market have normal distribution in +/- profits over time.)

Video 1. Play back of Rotational Movement

The above video shows the SPY and its 9 sector ETFs on how Rotation in the sectors take place over time.

(3) Set up

Figure 5. An example on dual monitors intra-day set up

This article is a continuation of the previous entry of the blog...

----------8< (Cut and paste from Wikipediaon Dow Theory >8------------

The Dow Theory on stock price movement is a form of technical analysis that includes some aspects of sector rotation.

------------------------------------------- 8<--------------------------------------------

As one can see from the above statement that the idea of Sector Rotation had been officially around for at least a century, but, if one were to flip through the whole library of Technical Analysis books in the library, he may not find more than 3% of the books mention about it(been there, done that). And, even if one can find such topic in the book, most of them merely touching the surface by introducing that there is such thing around.

Personally, I think that the traditional way of analyzing the price chart is hard to VISUALIZE how these rotation take place. Here is to introduce a tool that could facilitate the user to visualize and understand how the Rotational of the stocks/sectors are taking place in the market. Thanks for the exponential grow of personal computer's speed over the years and these CPU intensive tasks can be handled with ease nowadays. :-)

(1) Transformation of Traditional Chart into a X-Y Cartesian Plane.

Figure 1: Transformation of Traditional Chart into a X-Y Cartesian Plane.

Figure 1 shows how a normal chart can be transformed into The Galaxy Chart in showing the Relative Momentum and Trend of multiple stocks. Though the human eyes can ONLY see the 2-dimensional chart, it is up to the programmers' IMAGINATION to incorporate N-dimensional information into it. For instance, add a filter to get rid of those stocks that are moving side way.

(2) Understanding the meaning of The Galaxy Chart

Figure 2. The Galaxy Chart

Figure 2 shows a typical Galaxy Chart. Every stock is represented with a comet-like diagram with multiple dots in its tail. The POSITION of the biggest dot in the comet represent the last bar's RELATIVE STRENGTH of the momentum and trend with respect to others stock in a same watch list. The length of the comet tail can be set by the user, and each additional dot appears on the tail mean an additional look-back period. Therefore, the DIRECTION and LENGTH between the dots show the change of strength in Momentum and Trend dynamically over time. So, it provides more information than a normal static list of stock scan from explorer as it shows the dynamic trail.

Figure 3. Zooming-in to the Upper Right Corner where both Momentum and Trend are both Postive.

Figure 4. Statiscal and Probability wise...

.

Figure 4 is to illustrate how to focus on the fastest moving stocks visually. Note that there is a criss- cross with grid lines in the center of the chart, which represent the (0,0) origin position of the X-Y co-ordinate. The upper half of the chart represent the +ve momentum and lower half of the chart represent -ve momentum. While the right hand side of the chart represent the +ve trend, and the left hand side represent the -ve trend.

Therefore, the top right corner of the chart can only be populated with stocks that are both +ve in momentum and trend. The further away from the center are the faster the runner, and they are not range-bound. While the bottom left corner is just exactly opposite. (Note that the distribution chart in the figure is for illustration purpose ONLY, it does not mean that the stocks in the market have normal distribution in +/- profits over time.)

Video 1. Play back of Rotational Movement

The above video shows the SPY and its 9 sector ETFs on how Rotation in the sectors take place over time.

(3) Set up

Figure 5. An example on dual monitors intra-day set up

This is user preference...

It can be in various time frame. Start from Intra-day to Monthly.

(4) Caution!

Although any programmer with graphic programming experience can build up this platform within a week or so...

And:

(a) Knowing to use the right alogrithms to feed in the X-Y co-ordinate is the key. GIGO(garbage in garbage out)!

(b) The sector rotation concept is simply another form of Trend Trading. Therefore, it inherited a drawback from the Trend Trading Methodology. That is the deep drawndown during the change of trend, where the fastest stocks could fall the fastest and weakest stock rebound the fastest. Therefore, a very STRONG filtering technology MUST be built-in to the system to prevent such thing to happen during such period -> take the profits or cut losses quick. Such as Vibration Energy Filter or any equivalent... Then it can be considered as a complete system.

(5) Conclusion

The last few articles are shared not because the author/programmer, I AM, do not understand nor under estimate their value and shared them accidentally. Rather, they are shared because I strongly believe that when these concepts is fan out openly... it may be duplicated to a certain degree that could help the general public to equip themselves with a better understanding and tools to handle the market.

Just to side track with a small story that happened in my kid's science class not long ago...

The teacher in the class asked the students that "What If Thomas Edison did not invent the light bulb?" Then looking for the standard answer: "Oh! We are still having to light the candle at night!"

"NO! NO! NO!" I told her...

"If Thomas Edison did not invent the light bulb. Someone else would have invented it just slightly later. Or, if someone else did not invented the light bulb, daddy - me could have invented the light bulb. And, if I don't invented the light bulb, you may have the chance to invent the light bulb yourself!" Then I had to add, "Now you know the real answer, BUT, in the school test or exam, you MUST use your teacher's answer."

The morale of telling this story is that... If one don't share it, someone else down the road would share it anyway.

Happy reading.

KH Tang

<Home>

Control your Finances with Top Financial Tips

At present there are numerous people who are unable to control their expenses and feel that they can never recover from their financial mayhem. But nothing is impossible; if you feel that attaining financial stability is out of your reach, here are some steps that can be taken now to put you in a better financial position in the future.

Tip 1: Spend within your Means

The initial step you need to take is to know how much you spend monthly and how much you are earning; spend only within your earnings never exceed it. The best way to implement is to stay away from your credit cards; when you are in financial difficulties, credit cards dig a deeper financial hole for you. If there are some emergencies arising and you are in need of instant cash you can opt for a payday loan, it will provide you with the cash instantly and you can pay it back with your next paycheck.

Tip 2: Organise your Finances

If you neglect paying your bills on time and ignore your credit card payments thinking that you can do that later on, it would ultimately lead you in late payment fees and penalties. This could also lead you in tarnished credit reports and a lower credit score. To avoid such situations the first thing you need to do is to be financially organised. Prepare a cash-flow calendar for everyone in the home who earns money. Then write down which bills are to be paid on what dates and by whom. This will help to get in a good financial position and become more financially stable.

Tip 3: Track your Expenses

It is very important for you to know where your earnings are being spent. Keep a proper track of all your spending’s for a month this will give you a detailed plan who is spending how much and where. Then according to your spending’s in the house you can prepare a monthly budget plan covering all the necessities and save up some money for the future requirements.

Tip 4: Improve your Credit

If your credit reports are becoming weak because of your recent spending, then work on improving it. Start to prepare a plan for repayments of your debts; initially begin to pay with a smaller amount and then increase it gradually. Your recent payments will create a stronger impact on your credit score and ultimately improve it.

By following each of the above mentioned tips you pave your way to a stronger financial ground.

My name is Michelle. I am a tech writer from UK. I am into Finance.

Tip 1: Spend within your Means

The initial step you need to take is to know how much you spend monthly and how much you are earning; spend only within your earnings never exceed it. The best way to implement is to stay away from your credit cards; when you are in financial difficulties, credit cards dig a deeper financial hole for you. If there are some emergencies arising and you are in need of instant cash you can opt for a payday loan, it will provide you with the cash instantly and you can pay it back with your next paycheck.

Tip 2: Organise your Finances

If you neglect paying your bills on time and ignore your credit card payments thinking that you can do that later on, it would ultimately lead you in late payment fees and penalties. This could also lead you in tarnished credit reports and a lower credit score. To avoid such situations the first thing you need to do is to be financially organised. Prepare a cash-flow calendar for everyone in the home who earns money. Then write down which bills are to be paid on what dates and by whom. This will help to get in a good financial position and become more financially stable.

Tip 3: Track your Expenses

It is very important for you to know where your earnings are being spent. Keep a proper track of all your spending’s for a month this will give you a detailed plan who is spending how much and where. Then according to your spending’s in the house you can prepare a monthly budget plan covering all the necessities and save up some money for the future requirements.

Tip 4: Improve your Credit

If your credit reports are becoming weak because of your recent spending, then work on improving it. Start to prepare a plan for repayments of your debts; initially begin to pay with a smaller amount and then increase it gradually. Your recent payments will create a stronger impact on your credit score and ultimately improve it.

By following each of the above mentioned tips you pave your way to a stronger financial ground.

My name is Michelle. I am a tech writer from UK. I am into Finance.

Kamis, 12 Juli 2012

Insuring Your Home Inexpensively And Effectively

The process of buying a new home can be exciting, but it can also get very expensive. There are a number of different items that you'll have to pay for along the way which you may not expect on the front end. One of the expenses that many people do not plan for is homeowners insurance. If you want to insure your home inexpensively and effectively, there are a few different types of policies that you could buy:

HO-1

HO-1 is one of the most basic forms of insurance coverage that is available. With HO-1, you get covered against 10 specific types of damage to your property. This type of insurance does not cover anything related to liability coverage. This type of policy is not commonly purchased, but it can save you some money if you are strapped for cash.

HO-2

HO-2 is another type of home insurance that provides a little bit better coverage than what you'll get with HO-2. This type of policy only covers against specific perils, but it has more named perils than HO-1.

HO-3

HO-3 is the most commonly purchased type of homeowners insurance. With HO-3 coverage, you are covered for every kind of damage except those that are specifically excluded by the policy. This provides some of the broadest homeowners insurance coverage that is available.

HO-4

HO-4 is a type of renter's insurance that tenants can buy. This type of policy covers only the things that you have inside the property and protects you from liability claims. If you are a renter, using this form of insurance and resources like Rentler can help you save money.

HO-5

HO-5 is a policy that provides a very broad coverage for your home. It is similar to the HO-3 policy in that it provides coverage for everything that is not specifically excluded by the policy. There are only a few things that are excluded, and everything else is covered by the insurance policy. This probably isn't the policy that you want to get if you are trying to save money. It is one of the more expensive policies out there.

Regardless of what type of policy you choose, make sure that it provides the coverage that you need to achieve some peace of mind. You'll be able to protect your home and your financial position for the future.

Langganan:

Komentar (Atom)

.jpg)